south dakota sales tax rates by city

Our dataset includes all local sales tax jurisdictions in South Dakota at state county city and district levels. Lowest sales tax 45 Highest sales tax 75 This.

Sales Use Tax South Dakota Department Of Revenue

31 rows City Total Sales Tax Rate.

. 45 Municipal Sales Tax and Use Tax Applies to all sales of products and services that are. South Dakota Sales Tax45. Lowest sales tax 45.

31 rows South Dakota SD Sales Tax Rates by City The state sales tax rate in South Dakota is 4500. Aberdeen SD Sales Tax Rate. Akaska SD Sales Tax Rate.

Decrease the sales tax from 635 to 599 from. What is the sales tax rate in Wall South Dakota. This is the total of state county and city sales tax.

The minimum combined 2022 sales tax rate for Wall South Dakota is. However the taxes posted DO NOT show whether a tax has been paid. There is no applicable county tax.

The minimum combined 2022 sales tax rate for Black Hawk South Dakota is. The sales tax jurisdiction name is Clark. The South Dakota sales tax and use tax rates are 45.

The South Dakota sales tax and use tax rates are 45. What is South Dakotas Sales Tax Rate. The Connecticut sales tax rate is currently.

366 rows 2022 List of South Dakota Local Sales Tax Rates. What is the sales tax rate in Black Hawk South Dakota. The tax data is broken down by zip code and additional locality information.

Aberdeen SD Sales Tax Rate. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Albee SD Sales Tax Rate.

South Dakota Sales Tax Map Legend. This is the total of state county and city sales tax. Click Search for Tax Rate Note.

Did South Dakota v. The County sales tax rate is. This is the total of state county and city sales tax rates.

The Rapid City South Dakota sales tax is 650 consisting of 450 South Dakota state sales tax and 200 Rapid City local sales taxesThe local sales tax consists of a 200 city. The base state sales tax rate in South Dakota is 45. The minimum combined 2022 sales tax rate for Prairie City South Dakota is.

The tourism tax on visitor-intensive businesses applies during the months of June July August and September. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. What Rates may Municipalities Impose.

57 rows All businesses licensed in South Dakota are also required to collect and remit municipal sales. There is no applicable county tax city tax or special tax. South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to and services.

You would need to contact either the Chemung County Treasurers Office at 607 737-2927 or the municipality. The East Hartford sales tax rate is. The 65 sales tax rate in Rapid City consists of 45 South Dakota state sales tax and 2 Rapid City tax.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Agar SD Sales Tax Rate. The 45 sales tax rate in Garden City consists of 45 South Dakota state sales tax.

For cities that have multiple zip codes you must enter or. Enter a street address and zip code or street address and city name into the provided spaces. If you need access to a database of all South Dakota local sales tax rates visit the sales tax data page.

Counties and cities can charge an additional local sales tax of up to 2 for a. What is the sales tax rate in Prairie City South Dakota. Total Sales Tax Rate.

South Dakota municipalities may impose a municipal. 4 lower than the maximum sales tax in SD. For more information see Tourism Tax Facts PDF or learn more on the.

Average Sales Tax Including Local Taxes.

Municipal Tax South Dakota Department Of Revenue

Sales Tax On Grocery Items Taxjar

Sales Taxes In The United States Wikipedia

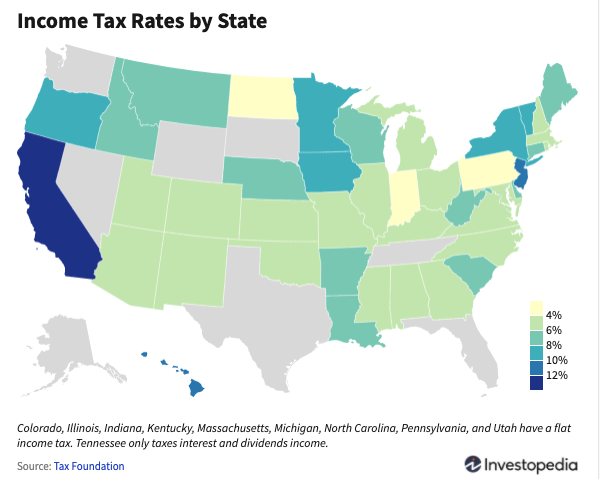

States With The Highest Lowest Tax Rates

South Dakota Property Tax Calculator Smartasset

Sales Taxes In The United States Wikipedia

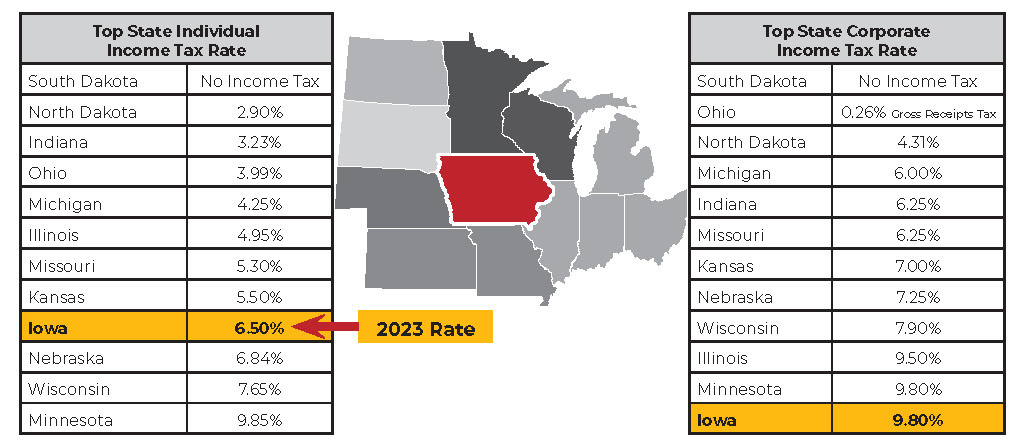

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Qod Updated How Many States Do Not Have State Income Taxes Blog

State Sales Tax Rates Sales Tax Institute

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

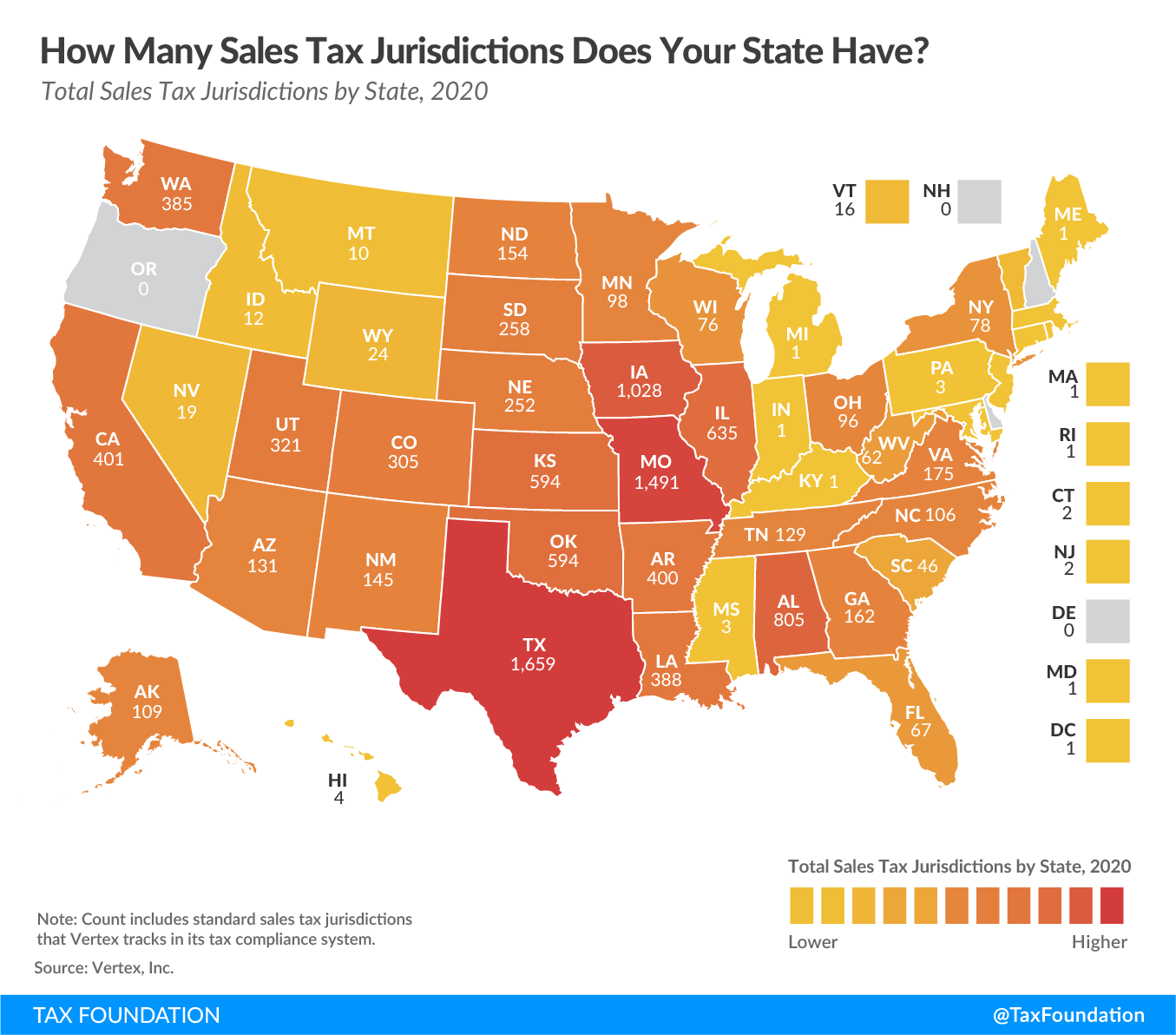

Sales Tax Jurisdictions By State 2020 Tax Foundation

Gov Noem Wants To Cut South Dakota S Grocery Sales Tax What To Know

Dor Map Gallery State Of South Dakota

Sales Taxes In The United States Wikipedia

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference